Cashplus Bank – In Brief

Cashplus Bank is a UK digital bank, offering a smartphone app and website based UK current account, fully licensed and regulated within the UK. They also offer various other associated products, such as a debit card and Creditbuilder, a way for people with a poor credit rating to improve it.

Table Of Contents

Cashplus Bank Pros & Cons

Pros:

- Consumers with a difficult financial history or poor credit rating may find it easier to open a Cashplus Bank account, and benefit from the Cashplus features.

- Cashplus Bank is a very simple and easy to use banking solution.

- Creditbuilder can help those with a bad credit rating improve it.

- Simple to set up, can be up and running in minutes, with no credit check on application.

- Optional overdraft available.

Cons:

- As a digital bank, Cashplus Bank do not have branches, so any issues would need to be dealt with via their chat or over the phone.

- Cashplus Bank does appear to have a large number of poor reviews on sites such as Trustpilot. However, Cashplus target customers who may have some financial issues, and these people may have more problems with banking.

- Cashplus Bank is designed to be very simple, and has few extras.

- No free account available.

What is Cashplus Bank?

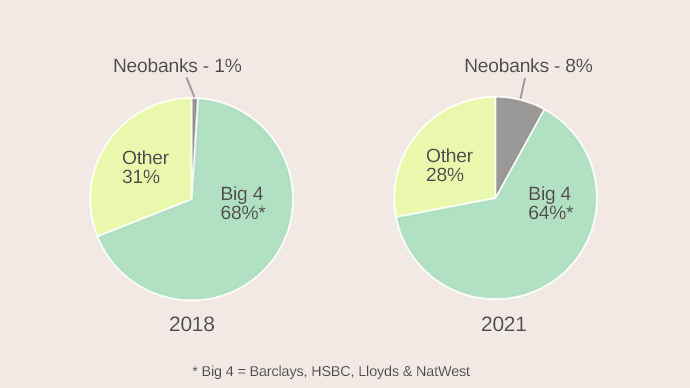

Cashplus are a relatively old company compared to their competitors in the UK digital bank market. They started way back in 2005, and were actually the first company to ever offer prepaid debit cards in the UK market. In 2021, Cashplus Bank was launched, and now they claim that over 1.6 million customers are using their services. In addition, Cashplus claim over 10 years of profitability, something that few (if any!) other fintech banks can claim.

Cashplus have positioned their bank account offering slightly differently than their competitors. From their background as a prepaid debit card provider, they are aware of, and had a customer base of people with poor credit, who struggled to get bank accounts, debit cards and credit cards in the past. Therefore, they have aimed their products at this market, to create a simple to access and use banking service, that can also help users to improve their credit.

Cashplus Bank Features

- UK current account – fully featured account

- No credit checks with opening an account – great for those with poor credit

- Mastercard debit card – including contactless functionality

- Deposit cash into your account – via Post Office branches

- Simple to use smartphone app – so you can bank on the go

- UK based customer service team – resolve issues quickly

- Purchase Protection on debit card – purchase risk-free

- Overdraft – available to eligible customers

- Loan – available to eligible customers

In addition, Cashplus offer Creditbuilder which is available to users on the Activeplus plan. It is designed to help consumers who have a poor credit rating or no credit history. The way that it works is that Cashplus ‘loan’ the customer the total annual cost of the Activeplus account fees – a total of £71.40. They then take the £5.95 fee each month, thus paying off the loan. This gives the customer a credit history, which can assist with improving their credit rating.

Who is Cashplus Bank for?

Cashplus Bank started their business in 2005 as a provider of prepaid debit cards (in fact as the first provider of that product in the UK). A large part of their customer base would have been people who, for whatever reason, were not able to get a normal debit card. Many of these people would be people who would have had financial problems in the past and may have a poor credit rating.

Therefore, Cashplus already had experience with customers who had this type of issue, and when they launched Cashplus Bank in 2021, they targeted them, with a product suite that can assist.

Therefore, if you have had this sort of issue in the past, Cashplus Bank can be a good way to get into the world of digital banking, and also to utilise their other products such as Creditbuilder, that can help with your credit rating.

Cashplus Bank Costs & Fees

Cashplus has 2 types of current account, each with a different fee structure:

| Account Type | Activeplus | Freedom |

| Card Issue Fee | £5.95 | £9.95 |

| Monthly Account Fee | £5.95 | Free |

| UK Card Purchases | Free | Free |

| Electronic Payments & Transfers | Free up to 9 per month. Any payments above that amount are charged at £0.99 per transfer | Free up to 9 per month. Any payments above that amount are charged at £0.99 per transfer |

| Additional Cards | £5.95 | £5.95 |

| Deposit Cash at UK Post Offices | 0.3% of the amount deposited (minimum £2) | 0.3% of the amount deposited (minimum £2) |

| ATM Withdrawals (UK) | £2 per withdrawal | Free |

| ATM Withdrawals (Abroad) | £3 per withdrawal | £3 per withdrawal |

Is Cashplus Bank Safe?

In 2021, Cashplus Bank received their full UK banking license. Therefore, they are now regulated by the Financial Conduct Authority (FCA), and regulated and authorised by the Prudential Regulation Authority. In addition, customer deposits are now covered under the Financial Services Compensation Scheme (FSCS) up to £85,000 per customer.

Cashplus Bank Customer Reviews

On Trustpilot, Cashplus Bank have a rating of 4 out of 5 from around 7500 reviews. Of these reviews, 52% give the maximum score of 5 out of 5. These satisfied customers praise the ease of use of the bank and the responsive customer services.

31% of the reviews are rated at 1 out of 5 – the lowest score. Many of the unhappy customers appear to be very angry and many complain of accounts being frozen and customer services not resolving issues. This percentage of low scores is quite high in comparison to other digital banks. However, Cashplus Bank do specifically target customers who have had financial issues in the past, and potentially this could be why they have more customers with issues.

Cashplus Bank Comparisons

Which is better – Cashplus Bank or Starling Bank?

| Cashplus Bank | Starling Bank | |

| Pricing | £5.95 or £9.95 monthly | Free |

| ATM Withdrawals | From free to £2 per withdrawal | Free UK & Abroad |

| Safety/Security | Deposits protected under FSCS | Deposits protected under FSCS |

| Extras | None | None |

Read our full Cashplus Bank vs Starling Bank comparison

Which is better – Cashplus Bank or Monzo

| Cashplus Bank | Monzo | |

| Pricing | £5.95 or £9.95 monthly | From £5 to £15 Details |

| ATM Withdrawals | From free to £2 per withdrawal | Free in UK, 3% abroad if over limit |

| Safety/Security | Deposits protected under FSCS | Deposits protected under FSCS |

| Extras | None | Many options |

Read our full Cashplus Bank vs Monzo comparison

Which is better – Cashplus Bank or Revolut?

| Cashplus Bank | Revolut | |

| Pricing | £5.95 or £9.95 monthly | From free to £12.99 Details |

| ATM Withdrawals | From free to £2 per withdrawal | Free with limits Details |

| Safety/Security | Deposits protected under FSCS | Deposits NOT protected under FSCS |

| Extras | None | Many options Details |

Cashplus Bank FAQ

Is Cashplus a proper bank?

In 2021, Cashplus Bank were awarded their full UK banking license, so they are now regulated by the Financial Conduct Authority (FCA), and regulated and authorised by the Prudential Regulation Authority in the UK. This means that they are a fully proper bank just like any other bank in the UK.

Cashplus app

The Cashplus Bank app is the heart of their account, and customers can use the app to do all of their banking functions. It is simple to navigate and use and makes banking easy.

Who owns Cashplus Bank?

Cashplus Bank is owned by a company called Advanced Payment Solutions Ltd (APS). They have been running financial products since 2005, initially being the first company in the UK to offer a prepaid debit card. In 2021 they launched Cashplus Bank.

What is a Cashplus card?

Cashplus Bank offer a Mastercard debit card that holders of current accounts get, and that has full contactless functionality.

Does Cashplus Bank have a business Account?

Yes, Cashplus Bank offer a business banking version of their account that offers a wide variety of useful features.

Cashplus Bank Verdict

Cashplus Bank is clearly aimed at those who have had financial and credit rating issues in the past, and it can really benefit these customers. However, even if you have not had any of these issues, but are simply looking for an easy to use, simple and no-frills digital bank, then Cashplus can still be an option worth considering.

Articles on the wiseabout.money website may contain affiliate links. If you click these links, we may receive compensation. This has no impact on our editorial and any money earned helps us to continue to provide the useful information on our site.