About Starling Bank

One of the first digital challenger banks in the UK, Starling Bank have taken many customers from the traditional high street banks, gaining over 2 million new customers in the last few years. They are also trusted as the main bank account by many of these users, unlike some of their competitors who are often used as a secondary account.

About Cashplus Bank

Cashplus Bank is a digital bank, offering a current account and debit card, based around a smartphone app. Fully authorized and regulated by the Financial Conduct Authority and Prudential Regulation Authority in the UK, they also offer other products, such as Creditbuilder, a way for people with a bad credit rating to improve it.

Contents

Starling Bank vs Cashplus Bank – At a Glance

| Cashplus Bank | Starling Bank | |

| Monthly Cost | Free or £5.95 per month | Free |

| ATM Withdrawals-UK | £2 on Activeplus, free on Freedom | Free |

| ATM Withdrawals-Abroad | £3 per withdrawal | Free |

| Debit Card | Green, blue, black + contactless | Teal card, vertical design |

| Interest | No | 0.05% on balances up to £80,000 |

| Cash Deposits | via Post Office | Post Office, £1000/year free, then 0.7% |

| Cheque Deposits | Not supported | Scan via the app |

| Money Management | Basic tools available | Spaces, Spending Insights |

| FSCS Protection | Yes | Yes |

| Instant Notifications | Yes | Yes |

| Customer Services | Telephone, in-app | In-app, telephone, email |

| Mobile Payments | Apple Pay, Google Pay | Apple Pay, Google Pay, Samsung Pay |

| Currency Transfers | USD, EUR currency cards | 0.4% charge |

| Extras | Creditbuilder, Travel cards | None |

| Business Account | Yes | Yes |

| Child Account | Child cards on adult account | Yes |

Starling Bank vs Cashplus Bank – Plans, Costs & Fees

Cashplus Bank

Cashplus has 2 types of current account, each with a different fee structure:

| Type | Active Plus | Freedom |

| Card Issue Fee | £5.95 | £9.95 |

| Monthly Account Fee | £5.95 | Free |

| UK Card Purchases | Free | Free |

| Electronic Payments & Transfers | Free up to 9 per month. Any payments above that amount are charged at £0.99 per transfer | Free up to 9 per month. Any payments above that amount are charged at £0.99 per transfer |

| Additional Cards | £5.95 | £5.95 |

| Deposit Cash at UK Post Offices | 0.3% of the amount deposited (minimum £2) | 0.3% of the amount deposited (minimum £2) |

| ATM Withdrawals (UK) | £2 per withdrawal | Free |

| ATM Withdrawals (Abroad) | £3 per withdrawal | £3 per withdrawal |

Starling Bank

Starling Bank keep it simple; they only have one account tier, which is free. There is no monthly paid option, and every account feature is available on the free plan.

Starling Bank do not charge for ATM withdrawals.

Cash can be paid into your Starling Bank account via the Post Office, and there is no charge for this.

Verdict

Starling Bank are very hard to compete with on cost. Their service is virtually fee-free, with no charges for ATM withdrawals in the UK or abroad. Cashplus Bank do have monthly costs on their Activeplus account, however there is no cost on the Freedom tier, and they do have some charges for ATM withdrawals. However, within the Cashplus costs there are some features which can be very useful to some people, for example those with bad credit, so for them, these costs can be worth it.

Starling Bank vs Cashplus Bank – Features

Cashplus Bank

- UK current account – fully featured account

- No credit checks with opening an account – great for those with poor credit

- Mastercard debit card – including contactless functionality

- Deposit cash into your account – via Post Office branches

- Simple to use smartphone app – so you can bank on the go

- UK based customer service team – resolve issues quickly

- Purchase Protection on debit card – purchase risk-free

- Overdraft – available to eligible customers

- Travel cards – Euro and USD debit cards to use whilst abroad available

- Loan – available to eligible customers

Cashplus offer their Creditbuilder service on their Activeplus plan. It is for customers with a bad credit rating. It works by Cashplus Bank ‘loaning’ the customer the total annual cost of the subscription – which is £5.95 per month, or £71.40 per year. They then take the £5.95 from the customer each month, which pays off the ‘loan’. This gives the customer a credit history, which can help with their credit rating.

Starling Bank

- Easy to use smartphone app – bank on the go, 24/7.

- Instant Notifications – get informed of any activity on your account immediately

- Spaces – Spaces are ‘virtual piggy banks’ within your Starling Bank account, where you can split your money into different areas i.e. bills, saving etc.

- Categorised Spending Insights – Within the app you can analyse your spending via categories to allow you to manage your money more efficiently.

- Starling Bank Marketplace – Starling Bank recommend other financial services – such as insurance, mortgages, pensions and more.

- Free ATM Withdrawals – Starling Bank offer free ATM withdrawals in the UK and within Europe and do not have limits on the free amounts you can take out.

- Savings Goals – easily set up within the app

- Mastercard Debit Card – with full contactless functionality

- Freeze your debit card – instantly stop the card via the app if it is lost or stolen.

- Interest on your current account balance – 0.05% on balances up to £85,000.

- Pay in cash via Post Office branches – up to £1000 per year free.

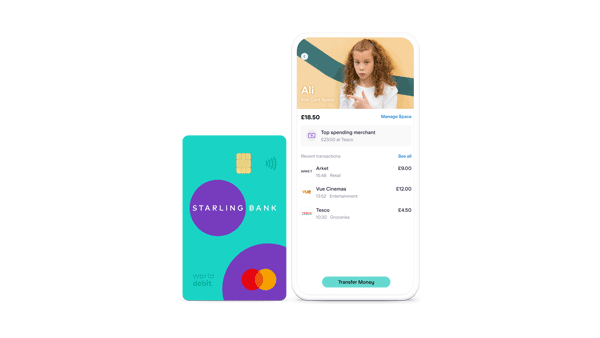

- Starling Kite – the bank account for kids that come with a debit card.

Debit Cards

Cashplus Bank

Cashplus Bank offer a Mastercard debit card with full contactless functionality, and Apple Pay and Google Pay enabled. Personal account cards are blue or green and the business card is black.

Starling

All Starling Bank current account holders get a Mastercard debit card. It has full contactless functionality and is enabled for Apple Pay, Google Pay and Samsung Pay. The card for personal account holders is teal, whilst the business debit card is black, and both have a vertical design.

Starling Bank vs Cashplus Bank – Safety

Are digital challenger banks safe?

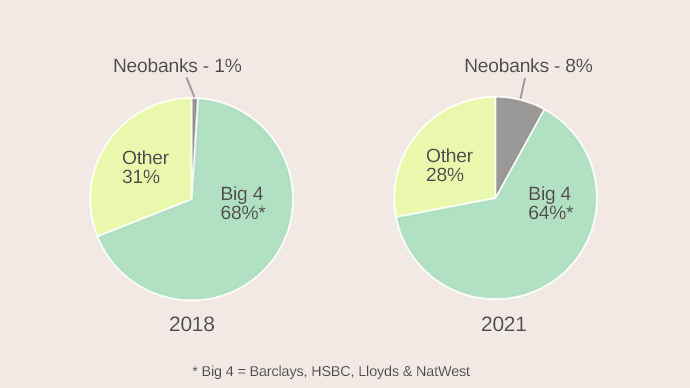

Digital online banks are generally as safe as their traditional high street alternatives. They are regulated by the same body – the Financial Conduct Authority (FCA), and have security and safeguards in place to protect your money. Both Starling Bank and Cashplus Bank are fully licensed UK banks, which means that customer deposits are covered under the FSCS up to £85,000, in case the bank goes out of business. Some other current account providers, such as Revolut and Monese, are not currently licensed banks.

Cashplus Bank

In 2021, Cashplus Bank received their full UK banking license. Therefore, they are now regulated by the Financial Conduct Authority (FCA), and regulated and authorised by the Prudential Regulation Authority. In addition, customer deposits are now covered under the Financial Services Compensation Scheme (FSCS) up to £85,000 per customer.

Starling Bank

As they are a licensed UK bank Starling Bank customer deposits are insured up to £85,000 per customer under the Financial Services Compensation Scheme (FSCS).

In 2021 they received the highest score out of all banks in the UK in a study by consumer group Which? that looked at banking security.

Your debit card can be instantly frozen and unfrozen via your app.

Verdict

Both Starling Bank and Cashplus Bank are fully licensed and regulated UK banks, and as such have a range of protections that keep customers safe. In addition, both are stable and profitable companies.

Starling Bank vs Cashplus Bank – Business Banking

Cashplus bank

The Cashplus Bank business account has 2 tiers – Business Go, which is free, and Business Extra, with costs £9.00 per month. Features include:

- Accounting software – integrate with Xero, Quickbooks and Sage

- Business Creditbuilder – improve your credit score

- Account balance limits – £50,000 on Go, £250,000 on Extra

- Cash deposits – via the Post Office

- Spending reports – to help manage your money

- Additional debit cards – for your team

Starling Bank

Whilst the basic Starling Bank Business account is free, for £7 per month you can sign up for the Business Toolkit – which contains the following features:

- Instant Invoices – sent directly from the app

- Automated Expenses – separate your expenses into categories

- Tax Estimates – the app analyses your account and estimates the taxes due

- Record & Submit VAT – get a running total of the VAT position.

- Bills Sorter – upload bills and schedule payments.

- Accounting Software Integration – Xero, Quickbooks and more

- Business Spending Insights – account analytics

- Business Spaces – categorise your funds

Read our full Starling Bank Business Review.

Starling Bank vs Cashplus Bank – Travelling

Cashplus Bank

- When spending with the card abroad, there is a fee of 2.99%

- ATM withdrawals abroad cost £3 per withdrawal

- Cashplus Bank offer Euro & USD travel debit cards that you can use when abroad. They are free to add on your account and with them you can avoid the fees.

Starling Bank

- Payments with debit card are free overseas

- Free-free ATM withdrawals abroad, with no limit

- Starling convert at the interbank rate, with a fee of 0.4% of the amount converted, on currency transfers.

Verdict

Starling Bank have a very simple, transparent and cheap suite of features for the traveller which is hard to beat. However, if you are travelling within Europe or the USA, the Cashplus Bank Euro and USD Travel Cards can be very useful.

Starling Banks vs Cashplus Bank – Child accounts

A normal account with Cashplus Bank or Starling Bank requires the account holder to be over 18. However both banks offer options for the under 18s.

Starling Bank – Kite

Starling’s Kite product is an add-on to a standard Starling Bank account. You can get a card for a child, that is fully controlled by the main account. The extra card is free of charge, and allows a full range of backing and payment activities, with full visibility for the adult.

Cashplus Bank

Similar to Starling, Cashplus account holders can apply for an addition card for a dependent aged between 13 and 18, with the card controlled by the main account holder.

Starling Bank vs Cashplus Bank – Mobile App

Starling Bank’s app is easy to use and intuitive, and in 2021 won the Best Banking App award at the 2021 British Bank Awards.

The Cashplus Bank app, whilst a little more basic than some competitors, has been praised for its ease of use and simplicity.

Starling Bank vs Cashplus Bank – Extras

Cashplus Bank

Cashplus Bank have aimed their product at users who may have had financial issues in the past, and several elements of their service are useful for these people. For example, they have no credit check when applying for an account, and their Creditbuilder service can be very useful for customers looking to build a credit history.

Starling Bank

As mentioned frequently in this article, Starling Bank do not have many extras, as they have focused on their core banking product. Customers can access the Starling Bank Marketplace, where offers from other financial providers can be accessed.

Verdict

Starling Bank don’t really offer extras as such. Cashplus Bank do have some extra features that could be very useful to those who had had credit issues in the past.

Starling Bank vs Cashplus Bank – FAQ

Is Starling Bank the best bank in the UK?

Over 2 million people in the UK have joined Starling Bank in the last few years, so clearly many people think they are the best bank in the UK. However, there are many other digital banks that are worth mentioning as potentially being the best, from Monzo, to Revolut, Cashplus Bank and even Wise.

Is Cashplus Bank a bank in the UK?

Yes, Cashplus Bank is owned by Advanced Payment Systems Ltd (APS) who are authorized and regulated by the Financial Conduct Authority and Prudential Regulation Authority in the UK.

Is Starling Bank a trustworthy bank?

Starling Bank are a fully licensed UK bank in the UK and are regulated by the Financial Conduct Authority. They have millions of customers and there are no specific issues to note.

Which UK bank account is best?

Choosing the best bank in the UK is a very difficult process, as there are so many options and each one has its strengths and weaknesses. Starling Bank could be the best for core banking, but Monzo is great for extras, Revolut has many different financial products under one roof, Cashplus Bank is good for those with a poor credit rating, and Wise perfect for frequent travellers.

Verdict

The Starling Bank banking product is very hard to beat, with its simplicity, ease of use and low cost. However, out of all of the digital banking competitors, Cashplus Bank is actually very close to Starling Bank in many ways. They both focus on the core functions of banking, rather than add any flashy extras. For certain types of customers, such as those who have had credit problems in the past, Cashplus Bank can be really useful and suit them perfectly.

Articles on the wiseabout.money website may contain affiliate links. If you click these links, we may receive compensation. This has no impact on our editorial and any money earned helps us to continue to provide the useful information on our site.