ANNA Business Account – In Brief

ANNA Money was launched in 2017, with the aim of simplifying the lives of small business owners, by presenting a range of financial features that would save time and stress. ANNA is an acronym for ‘Absolutely No Nonsense Admin’ (which is also the name of the company behind the app), which definitely shows their intentions with the product. In addition to the current account functions, they offer other business related tools. Our ANNA business account review gives you all of the details you need.

Table Of Contents

ANNA Business Pros & Cons

Pros:

- Useful financial admin tools for small businesses

- Money management tools

- Connect other business and personal accounts via open banking

- Can definitely save time for business owners

Cons:

- Deposits not covered under FSCS

- Costs for transfers into and out of account

What is the ANNA Business Account?

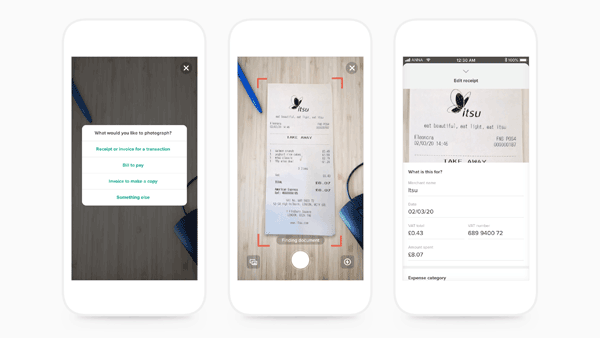

In addition to the e-money account which has the standard banking functions, ANNA Money has added a variety of tools that are designed to save time and simplify the financial admin side of running a business. These include their VAT filing, bookkeeping tools and taxes package. Running a business is hard enough before you even get to the finance side, so these elements can be very helpful to a sole trader or small business owner.

ANNA Business Account Features

- Business current account – e-money account

- Mastercard debit card – plus separate debit cards for employees

- Quick and easy to open account – be up and running in minutes

- Pay in cash – via PayPoint locations

- Dedicated payment link – put on social media or send to people directly

- Pots – create spaces within your account to separate your funds

- Instant notifications – any time any payment goes into or out of your account

- Scheduled payments – one-off payments in advance or recurring payments

- Cashback – 1% on certain items purchased with the debit card

- Connect other business and personal accounts – via open banking

In addition to the standard current account functions, ANNA also have business tools designed to ease the lives of small business owners:

They have divided this into 3 tiers – a basic free tier that has certain admin functions, then an additional VAT add-on, and a Taxes add-on, each of which have a monthly fee:

- VAT Filing

- Bookkeeping tools

- Creation and management of invoices

- Manage documents and receipts

- Director’s payroll

- VAT Upgrade – with monthly fee

- Taxes upgrade – with monthly fee

Who is the ANNA Business Account for?

Anna Money is only available to UK businesses, and the following types of business can open an account:

- Limited company (must be listed on Companies House)

- Sole trader

- Limited Liability Partnership (LLP)

In general, ANNA have developed a suite of features and tools that are designed to help the sole trader or small business owner reduce the complexity and time taken for the financial admin side of running a business. Therefore, they are really aiming their product at smaller businesses.

ANNA have tried to differentiate their product from other business banks by offering more comprehensive tools such as their VAT and Taxes upgrades, so that the product should help a small business owner save time on financial admin.

ANNA Business Account – Costs & Fees

ANNA Money has 3 account tiers. The free tier is called Pay As You Go, and on this there are charges for every account function. On the paid tiers, there is a monthly fee, and certain levels of functions are included as part of this cost. The 3 tiers, with their costs are:

Pay As You Go:

- Monthly Cost – free

- Local transfers into or out of the account – £0.20

- Card payments worldwide – free

- ATM Withdrawals – £1

- Cash deposits – 1% of the amount deposited

- International payments – £5 per transfer

- Currency conversion – 1% of the amount transferred

- Additional debit cards – £3 per card per month

ANNA Business:

- Monthly Cost – £14.90 per month/£149 per year

- Local transfers into or out of the account – 50 transfers included, then £0.20

- Card payments worldwide – free

- ATM Withdrawals – 3 included per month, then £1

- Cash deposits – up to £300 per month included, then 1% of the amount deposited

- International payments – 1 included per month, then £5 per transfer

- Currency conversion – 1% of the amount transferred

- Additional debit cards – up to 5 included, then £3 per card per month

ANNA Big Business:

- Monthly Cost – £49.90 per month/£499 per year

- Local transfers into or out of the account – free

- Card payments worldwide – free

- ATM Withdrawals – free

- Cash deposits – free

- International payments – 4 included per month, then £5 per transfer

- Currency conversion – 0.5% of the amount transferred

- Additional debit cards – unlimited

ANNA also provide their Business Tools, which include various useful financial functions. Many of these are included at no cost, but certain of them will be charged for:

- VAT Upgrade – £5 per month

- Taxes – £20 per month

Is the ANNA Business Account Safe?

Anna Money is not a licensed UK bank, but rather an e-money provider. This means that customer funds are not protected under the Financial Services Compensation Scheme (FSCS) in the event that the company fails. However, ANNA state that they protect customer money via ‘safeguarding’, which is a process whereby they are not able to loan or invest customer funds, and must keep customer funds separate from their company funds.

More about safeguarding

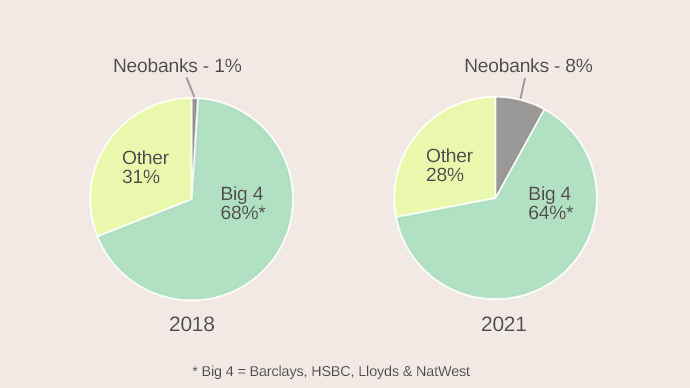

ANNA Business Account Alternatives

Compare the options in our Best Digital Business Bank UK article.

ANNA Business Account FAQ

Is ANNA Business account free?

There is not really a free version of the ANNA account. Their Pay As You Go account tier has no monthly fee. However as the name suggests, you will then need to pay a fee for each account function, such as transfers into or out of the account, ATM withdrawals, cash deposits etc.

Can I pay cash into my ANNA account?

Yes, it is possible to pay cash into your ANNA account at any PayPoint location. It will cost 1% of the amount deposited (unless you subscribe to ANNA Big Business), and certain limits on the amount you can deposit apply.

Is ANNA Business account legit?

As this ANNA business account review has detailed, ANNA Money is not a licensed UK bank. However, they are an e-money provider, and as such, they are fully regulated by the Financial Conduct Authority (FCA), and are a legit financial business.

Is ANNA money protected?

As they are not a licensed bank, customer funds are not protected under the FSCS. However, ANNA Money state that they protect customer funds via a process of ‘safeguarding’. This means that ANNA will never loan or invest customer funds, and also they have to keep the funds separate from their company funds.

ANNA Business Verdict

ANNA Money is an interesting addition to the business banking marketplace. Whilst they are not an actual bank, they do have most of the features that any business owner would need to run their business. More than that, however, they have added some more features that could really help. Any business owner wants to focus on their core business and not have to spend too much time on the accounting, financial and admin functions, and the VAT, taxes, and other useful functions that ANNA offers could definitely pay for themselves in time saved on these areas.

Articles on the wiseabout.money website may contain affiliate links. If you click these links, we may receive compensation. This has no impact on our editorial and any money earned helps us to continue to provide the useful information on our site.