It is always a good decision to start saving money. Whether it is a long term thing, such as a deposit for a house or retirement, or a shorter term goal, like a holiday or to build up an emergency fund. The most important thing is just to get started. The sooner you start, the quicker your money can start growing. However, to start with, what is a savings account, and how do savings accounts work?

How Savings Accounts Work

At its most simple, a savings account is a place to store your money. It is not essentially too different from using a piggy bank or putting your money under the mattress. However, it is a lot safer! There are many different providers of savings account, and most banks will have some sort of savings account to offer customers.

The most important difference between a savings account and just keeping your money hidden somewhere, is interest. Interest ensures that your money grows over time.

For example, if you have a savings account that pays a rate of interest if 1%, then each year that you have your money within the savings account, you will get 1% of the total amount you have saved in interest. For example if you kept £5000 in this savings account for 1 year, then at the end of the year your balance would be £5050, so you would have earned interest of £50.

Why you need a savings account

There are many reasons why having a savings account is a good idea. The most basic reason is that it gives you a way to separate your day to day spending from your savings, which allows you to see what you have to spend, and what you have saved.

What is Compound Interest?

Compound interest is interest on the interest of the initial borrowed or deposited amount. Sounds confusing? It is actually quite simple. If a bank offers a savings account with an interest rate of 5% per year, then the final amount of interest gained at the end of a period, on the initial amount would differ, depending on how often the interest is compounded.

Interest can be compounded in various periods, usually daily, monthly, quarterly or annually. The principal amount has the interest added to it in the daily, monthly, quarterly or annual payout cycles. As soon as the interest is added, that increases the principle amount, and that full new amount then has the interest rate applied to it in full, thus continuously increasing the principle amount that has the interest rate applied to it.

Compound interest is an incredibly powerful tool for you to grow your initial capital.

Pros of Savings Accounts

- Savings accounts are amongst the safest ways to store and grow your money. Usually savings accounts are protected under the Financial Services Compensation Scheme, up to £85,000 per customer, per institution.

- Every UK resident gets a personal savings allowance.

- Savers can take advantage of compound interest, which helps money to grow quicker.

Cons of Saving Accounts

- If the interest rate that you are getting on your savings is less than the rate of inflation, then your capital will actually be worth less in real terms over time.

- Often the rate of return on a savings account will be lower than with investments, such as with a stocks and shares ISA.

How Does a Savings Account Work?

Savings accounts are a very simple type of bank account and the best way to save money. Once you have chosen a bank account to save with, then you simply transfer the money into the account, and whatever you put in will start to earn interest. These days it is possible to do all of your banking online, so you can quickly and easily transfer money into your savings account and easily check your savings account online.

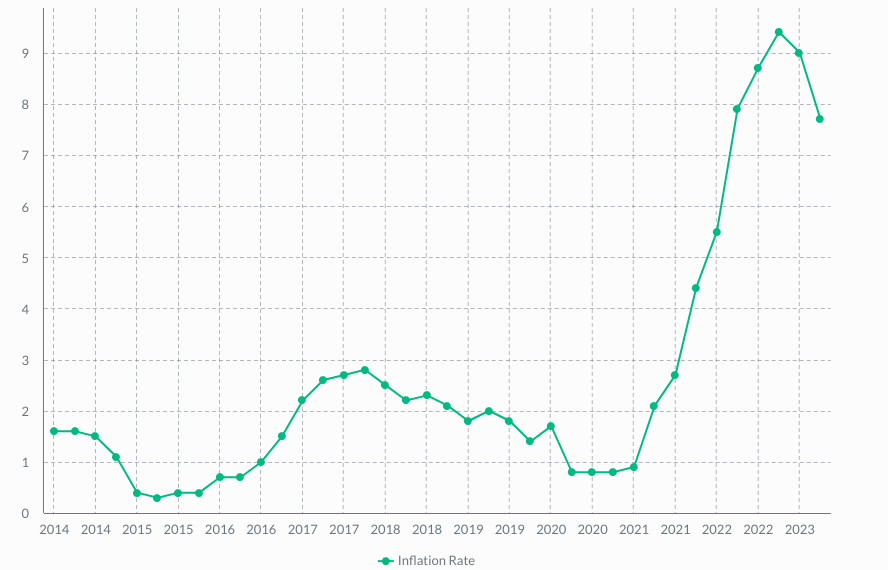

What is inflation?

Inflation is the percentage that the price of goods and services are rising. In the UK the government tracks the rate of inflation by measuring the prices of a basket of goods and services on a regular basis.

You should always be aware of inflation when assessing the interest rates on savings accounts.

If the interest rate you earn on your savings is less that the rate of inflation, then even though your money is growing, it is actually getting smaller in real terms. This means that you can buy less things with the same amount of money.

In Summer 2023, the annual rate of inflation in the UK was 6.5%. The highest savings interest rates are generally between 4% and 6%, it is not looking like a good time for savers!

However, it is better to be getting some interest on your money than none! It means that your capital is declining far more slowly than if you just left it in a low interest account.

Tax Allowances On Savings Accounts

The UK government have set up various ways to encourage people to save and invest. Included in this are tax benefits on savings. One of these are Individual Savings Accounts, which give everyone an annual allowance (£20,000 in the 2023/2024 financial year). This allowance can be invested into different types of ISA, such as a cash ISA (which is very similar to a savings account), and a stocks and shares ISA, which involves investments.

However, outside of ISAs, UK residents also get a tax free allowance on interest on savings. This means that tax payers can earn this amount of interest on their savings before having to pay tax on it.

- Basic Rate Taxpayer – £1000

- Higher Rate Taxpayer – £500

- Additional Rate Taxpayer – £0

How much money do you need to open a savings account?

It is possible to set up a savings account with as little as £1, so not having the funds is no excuse not to start! However, you should always analyse your finances thoroughly before starting to save, to ensure that it is the right thing for you at this stage.

For example, if you have short term, expensive debt, such as credit card debt, or loans, then it is better to prioritise paying off these loans with any spare cash, before starting to save. Generally short term debt will have a much higher rate of interest than a savings account, so you would be paying more for the interest on your debts than you would be earning on the interest of your savings.

What are the different types of savings accounts?

– Easy-Access/Instant Access Savings Account

These accounts are the standard savings accounts, and they usually have low rates of interest. They do however, have very few (if any) restrictions on the amount of money you can put in and take out (unlike some other types of savings account). These accounts work perfectly for emergency funds, as the money is easily accessible with no penalties. Sometimes these accounts are called variable rate savings accounts, as the rate of interest can go up and down.

– Regular Savings Account

The rate of interest on a regular savings account will often be higher than on an easy-access account, but you will need to commit to regularly putting in a set amount of money. There are often restrictions on these accounts, such as the amount you can put in in total, and how many withdrawals you can make

– Notice Account

Notice accounts only allow you to withdraw money after giving a certain amount of notice, often 45 or 60 days. The longer the period of notice, the higher the rate of interest.

– Fixed-rate Savings Account

Fixed-rate savings accounts will usually pay the highest rates of interest. To get this however, you need to lock your money away for a long period, usually 1, 2 or even 5 years. Withdrawing your money early will generally mean that penalties apply, so they are not good for situations where you may need to access the money quickly.

How to Open a Savings Account

Opening a new savings account is simple. There are many resources out there to help you choose the right savings account for you. One example is Raisin, which gathers together all of the top savings accounts offers out there so you can decide. Once you have chosen one, to open a savings account is just like setting up any other bank account. Simply register with the bank, verify your identity, and you are ready to start depositing money.

Can you lose money in a savings account?

Savings accounts are in many ways very safe, and designed to protect consumers from direct losses. By their nature, savings accounts do not expose the customers depositing money into them to the money markets, so the value of their savings will not go down. In addition, all banks in the UK are regulated by the FCA, and this means they have to follow very strict rules to protect customers money. It is rare for banks to go bust, but if they do, there are several ways in which your money is protected, including under the FSCS scheme which protects savers up to £85,000 per instutution.

However, there are other ways in which your money can lose value. We mentioned inflation before, and that can be the enemy of savers. If the rate of inflation is higher than the rate of interest you are getting on your savings, then in real terms, your money is actually shrinking. Therefore, it always makes sense to ensure you are getting the best rate of interest so you can mitigate this.

Are savings accounts safe?

Savings accounts are generally very safe. They are designed to help consumers save their money with little to no risk, and certainly have far less risk than investing. Most savings account providers will be regulated by the Financial Conduct Authority (FCA), which means they will have to adhere to a wide range of regulations. In addition, the funds will be covered by the Financial Services Compensation Scheme (FSCS), up to a total of £85,000.

What Savings Account Will Earn You the Most Money?

The savings account market is ever-changing, as the savings account rates earned on your capital changes due to many different things. In mid 2023, the rate of interest set by the Bank Of England is high, so banks are also offering high interest rates. There are many offers out there, so it makes sense to shop around, and check out sites like Raisin, which can give you an idea of the best current

What Is the Difference Between Current Accounts and Savings Accounts?

The biggest difference is that savings accounts pay interest. Some current accounts pay interest too, but it is usually a tiny amount so not worth bothering with. Also, whilst current accounts will have debit cards and other tools, savings accounts generally will not – which is a good thing, as you want to save the money in there, not spend it!

How do you start saving?

To start saving can be very hard, especially if money is tight, and you have not saved before. However, there are a few steps you can take to move towards getting into the savings habit.

- Do a financial audit

Go through all of your finances, and work out exactly where you are. This can be hard, but there is technology that can help. Budgeting apps such as Money Dashboard, Moneyhub and Snoop connect to your bank, and allow you to get an overview of your finances, so you can see where your money goes, and calculate how much you may be able to put aside on a regular basis.

- Pay off short term debt first

Short term debt, such as credit cards, store cards and loans generally have high rates of interest. This means that until you pay these off, you risk paying more in interest on your debt than you earn on your savings.

- Calculate an amount you can regularly save and keep saving regularly

Again, there are apps that will help calculate how much you can save and to hit your savings goals, such as the budgeting apps, or automatic savings apps such as Chip and Plum. Once you have set it up, then ensure you keep going, as you will be amazed how much it will grow over time.

What other alternatives are there to grow your money?

Cash ISA vs Savings Account

A savings account and a cash ISA are almost the same in many ways. They both allow you to deposit money into an account and earn interest on it. This means that they have the same pros, such as safety, and cons, such as the rate of interest often not matching the rate of inflation.

The real difference between the two is tax. Every year each UK resident gets an ISA allowance (which is £20,000 for the 2023/2024 tax year). This means that everyone can put up to £20,000 into a cash ISA, and any interest earned on that money is free of tax.

However, as we already mentioned, individuals also get a tax free allowance on interest too, so which is the best option?

It does make sense to take advantage of your ISA allowance as much as possible, as over time you can continue to take advantage of the tax allowance year on year.

However, if you do use an ISA, it does make sense to also keep some money for emergencies in an easy access savings account, so you don’t have to take money out of your ISA.

Stocks & Shares ISA vs Savings Accounts

Unlike a cash ISA, which is similar to a savings account, a stocks & shares ISA is very different, as it involves investments, which brings in a far higher element of risk.

Historically, it has been possible to make higher returns on your capital with investment than with savings accounts, especially if you invest for a longer period – ideally over 5 years. However, there is far more risk in investing, and it is possible to end up with less money than you started with, or even to lose your entire investment. It is possible to reduce your risk by using diversification, but nothing is guaranteed with investing!

As with the ISA, all UK residents get an allowance each year that they can put in, and any return made on these investments is tax free.

Many different investment platforms offer stocks and shares ISAs, and give the investor many different options. Some offer passive investment, which means that they create the investment strategy for you, and on others you will need to make the investment decisions yourself. For more information you can read our best investment platform UK article.

How Do You Close a Savings Account?

Closing a savings account is generally simple. However, bear in mind that if the savings account is a notice account, then you will have to give some notice, for example 45, 60 or 90 days, before you can take out the money. Also, with fixed-rate savings accounts, in return for giving you the high rate of interest, the bank will want you to commit to a fixed term, for example 3 years, during which time you cannot withdraw your money without incurring a penalty.