Debts can weigh heavily on the debtor’s shoulders. They can be the reason for countless sleepless nights and great stress.

If you feel that you have lost control of your finances, or if your bank statements leave you bewildered or anxious, then you may benefit from having a budget.

Some people might picture austere times devoid of light, with no fun whatsoever when it comes to having a budget, but actually, it is far from that!

It has the potential to be more fun! How many times are we buying things on a whim only to feel bad about ourselves and our bank balance shortly after? If there was a budget for these purchases in the first place, then we can go home happy and marvel at our bounty without guilt.

Admittedly, creating a budget can be a boring and tedious process, but the results will be beneficial and rewarding. Once it becomes a habit, it will become natural to have a monthly or even weekly budget. Also, there are a myriad of budgeting apps available in the UK that can make it enjoyable.

Further, a budget can be a big enabler of accumulating more wealth, because instead of mindless spending, you can control what you spend your money on, and assess whether the expense is actually worth it. In the long term in might open up opportunities that did seem out of reach when there was no budget in place. Opportunities such as saving for a down-payment on a house, a retirement plan, new car, investments etc…

So – here are:

4 Reasons why a budget can be a life changer

1: Reduction in anxiety

Are you dreading opening letters? Debt, or having no money left to pay bills creates a constant state of anxiety, and it’s a sure sign that a budget is needed. Everyone needs to pay bills, so an incoming bill should not result in a shock.

If a budget is allocated to every part of life, then a bill will not be such a big deal.

The best way to start is making a list of your monthly expenses. A budgeting app can help with this, or you can use go paper or a spreadsheet. Check your bank statements of the last 3 months and create a category for every item. For example a category for rent, one for bills, one for clothes and one for entertainment etc. The best approach is also to be as precise as possible. There are certain things that we do not have control of. For example utility bills can vary because these prices vary. If you own a car, fuel prices can also go up and down. As of February 2022 energy prices are expected to go up, so it would be best to be cautious and add a contingency amount to your budget. It is better to take the Stoic approach, expect to pay more, and be surprised if it’s less than expected.

If you overspent – review your budget. Perhaps it was unrealistic, or there are costs that have not been accounted for, such as insurance premiums that are paid yearly rather than monthly.

Celebrate your achievements. If you have managed to end the month under budget, treat yourself to something small and put the rest aside to save up for something sustainable in the future.

2: It prevents financial standstill

Not knowing where the money is going can result in just living payday to payday. Having nothing left at the end of the month leaves no security and nothing for potential opportunities in the future. The result is that, financially, nothing is going to change.

A budget can help to prevent that financial standstill, scrutinizing every expense enables better decisions. It can result in countless “Aha” moments, which can change your finances for the better.

3: Transparency of your finances

Here comes the boring part. In order to budget effectively, it’s crucial to know where the money goes. For this, it’s best to take some time and make a list. This requires a bit of effort and time, it won’t get done in an hour. But it’s worth doing it, because it’s crucial for keeping track of your expenditures. It is best to get a dedicated notebook or spreadsheet, just for budgeting purposes.

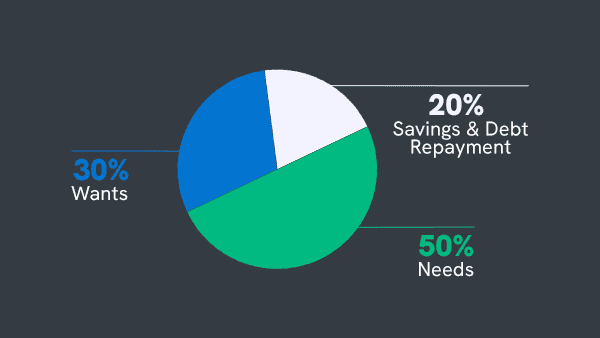

Make a note of everything that you’ve spent money on for the last 3 months. Break them down by category. Assign a score to everything based on importance and necessity. For example on a scale of 1-5, where 5 is important and 1 is not important, the category “rent” would get the score of 5. This will help to see how much is spent on the low scoring areas. Often, these are insidious and are easily missed.

For example, check if you have any subscriptions for apps on your mobile phone you don’t use. Also – cancel unused gym memberships. Sometimes, we keep that gym membership in the hope that we get into fitness. But then it never happens. So it’s best to cancel and renew when you are ready. The same goes for streaming services. Most of them are easy to cancel, so paying only whenever there is a show on that truly sparks joy could be a money saving option.

4: Financial responsibility can put you in control

Budgeting can become a habit just like anything else. After a few months of following a budgeting process and sticking to it, it’ll be unnatural without one. However, once the immediate money related matters are under control, it is time to start some actual planning. This is the part where you start to take advantage of your newly gained skill of budgeting.

Set goals for yourself. What would you want your financial existence to look like? How can you create stability and security for yourself? For example, you could make an emergency fund your next goal. If you already have an emergency fund, how about saving up for a down payment for a property, or a retirement fund? With sound budgeting, these goals can become a reality. Having financial control is liberating. Its gives you the foundation onto which you can build your future.

These days there are many tools out there to help you budget. Check out our reviews of the best budgeting apps around: Money Dashboard, Emma, Snoop, Moneyhub.