Minimalism and essentialism are ideas that helped me to rethink my choices. It is true, I do not wear most of the items in my wardrobe. The items that I am not wearing, I think I would have had more pleasure burning the money I bought them with than the short pleasure I felt in buying them.

Still, I kept wasting a lot of time in searching for things I could buy.

Apart from the bad financial side effects, overconsumption in clothes has another downside, the garment industry is not one that treats their workers fairly. Plus, the environment gets screwed by the production process, either due to exploitation of natural resources or harmful chemicals. The production affects both life and nature on our earth. As consumers we are enablers of these bad practices.

So I delved into minimalism.

I have followed minimalism, downsized and decluttered, but now what?

However, after erasing the visual clutter in my home, downsizing my wardrobe substantially, selling off other unwanted things and folding my clothes in a peculiar way, I have waited for the Eureka moment. Whats next? It doesn’t teach anything about money.

Sometimes, it feels like as if my life revolves around things. Even with minimalism, I felt I was obsessed by things. I wanted to think less about stuff and not more. But then gradually, my thinking adapted itself to my new situation and my thoughts about my finances and things started to change.

Trying out minimalism, in hindsight was somewhat like a reset button. On/Off. It’s like approaching food after a week long fast. Suddenly I thought differently about my financial existence: Consumerism was stopping me from my full potential, both financially and professionally. Consumption takes time. How many hours are you spending a week surfing through the web looking for things to buy, or not to buy, just checking out new additions of your favourite online store?

My consumerist behaviour is a result of the dissatisfaction in myself

Recently, I stumbled across the term ‘fantasy self’ here and there. It completely sums up my behaviours when I shop without need. Because, when I look at a piece of clothing, I see the person I “could” become when I own and wear it rather than the real me. It stems from a perpetual dissatisfaction in myself. And it’s very easy to do.

Reasons are manifold. Number one could be that advertisements are constantly showing us what we lack, instead of what we are good at and what we have. And, because we see so many more advertisements nowadays than we would have seen in the 80s and 90s, it is inevitable that after prolonged consumption we adopt the feelings and beliefs of inadequacy. Our consumption of media has increased and as a result consumption of goods has increased as well.

I am not trying to paint the picture all media equals bad, but the fact is, no one has ever prepared or warned us of the effects beforehand. We have slid unknowingly into it. Today, of course, there are many different voices that try to teach us about the dangers of excessive media consumption. However, it is not easy to detach and to live a life that is completely unaffected by it because there simply is no escape. Not many have the option of barricading oneself away from civilisation.

Freedom often necessitates financial means

Only a few can do this, but the majority simply can’t because any freedom, i.e. the ability to say no to certain things often necessitates financial means.

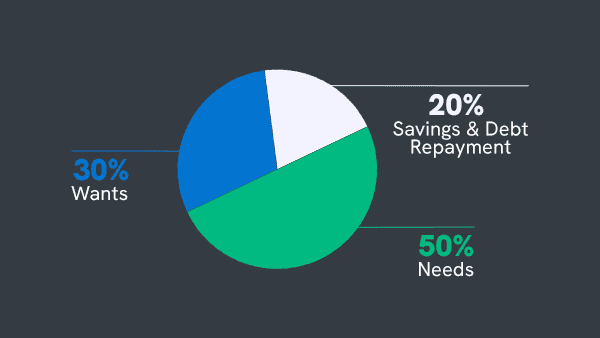

For many, this kind of freedom is unattainable. Saying no to certain things, being able to live off grid requires land and technology. All of which costs money. Living without a car requires people to be able to work from home or somewhere close to work, which in bigger cities might not be possible because rent would be astronomical. The point I am trying to get to is that, the never ending consumption stops us from growing our own assets. The assets we should be concentrating on are those that have long-lasting value. For example: investments for retirement, savings, properties and perhaps even art.

Easily attainable things are a financial trap

One way to get more assets is to spend less on things that are easy to afford, readily available, and do not keep their value. Clothes are such goods in 99% of cases. Let’s think about shoes and property and compare a 1-bed flat in Glasgow (to select a city at random) to a shoe collection.

A short search shows me that a one-bed flat in Glasgow is about 100,000 GBP, which at an exchange rate of 1.16 is 116,000 EUR. If the average cost of one pair of trainers or shoes is 100 GBP, this would be equal to a 1000 pairs of shoes. This sounds a lot of course. But lets’ look at it from a different perspective: we can’t wear a 1000 shoes at the same time. But we can protect all our family members in a house at the same time if we need to.

In this case, its’ best to not spend the money on 1000, or even 100 or 10 pairs of shoes because one could get something far more valuable for this.

So we end up in a trap, 100,000 GBP for a house seems unattainable. Shoes for 100 GBP, easy! We put our money into the things that are available now, easy to attain, without calculating, what we could get, if we saved the cash over time, and invested it into something that had future potential.

To become better with money, look at purchases from an investment angle

That is not say, that shoes are not an investment. They can be. Special edition trainers can increase in value over time. But to make money, one would need to know the market. Which, is not hard to do. All it requires is some study and research. This can be applied to many necessary purchases in life. Another example would be furniture. An original 1960s Danish design chair, likely will hold or increase its value over time, even from a no name brand, while a chair from some random high-street furniture company likely will not.

Of course, it is quite difficult to organise purchases based on whether it will increase in value over time, but its surely a good exercise to think about it. After all, we are all working hard for our money and we should be learning how to make that money work for us in a more sustainable way. So that we can create long-lasting benefits from our hard earned money for ourselves, rather than succumbing to the mindlessness of consumption.