What is an emergency fund?

Life doesn’t always go according to plan. For events that are out of our control such as the loss of a job or an illness, an emergency fund can make these events bearable and less scary.

An emergency fund should help during these unknowns. Ideally an emergency fund is large enough to cover 3-6 months of living expenses, such as rent, all bills and food. Plus, an allowance for unexpected but necessary purchases such as a new washing machine or repairs.

However, depending on how much security one would feel comfortable with, this can be expanded to 12 months.

Where to keep the emergency fund?

An emergency fund needs to be accessible at any time. A saving account with easy access would be best. Unfortunately, the interest rate on these accounts is not great but at least there will be ”some” interest rather than none. Parking the money in your current account usually offers no interest at all. And keeping that money out of sight helps to avoid the temptation to spend it.

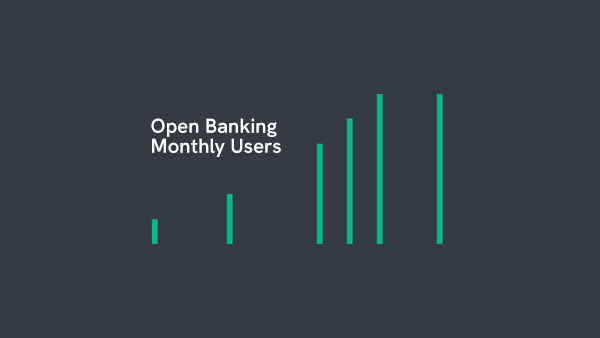

Modern app based banks often allow you to separate your money within your account. Check out our reviews of Starling Bank and Monzo for more details.

How much should I save?

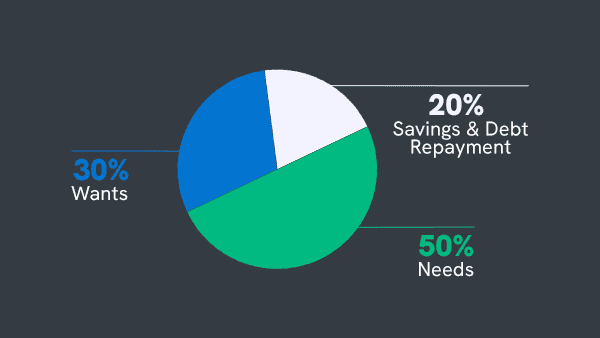

Monthly bank statements often show the incomings and outgoings of one month. The outgoings will give an indication of how much money is needed. The difference between incoming and outgoing money is how much could be saved. Once you know what you need every month, multiply it by 3, 6, 9, or 12 depending on your preference for the amount of months you want to cover. Also – a contingency fund should be added for any unforeseen expenses. This depends on a number of factors i.e. are you a homeowner, do you own a car that may need maintenance or repairs?

The next step is to figure out how to save up for the emergency fund.

How to save up for an emergency fund?

The biggest roadblock to saving would be not having enough money to save to begin with. For some, it is really difficult to save either because it is not as easy as it sounds to look after money, or you are working in a low wage field where there is simply nothing left at the end of the month. The former can be tackled with a few adjustments in spending, while the latter unfortunately is more likely a long term project.

Being financially savvy is not something we have been born with, nor is it unfortunately something we are taught in school. So, it doesn’t come as a surprise that some of us really have a hard time to save.

If your spending is below your income, then saving is easy. Simply transfer into a savings account what is left over at the end of the month until there is enough in the emergency fund.

How to save when there is hardly anything left at the end of the month?

Firstly, don’t stress. Do not expect to save up a vast amount of money in a short amount of time. Rather give yourself time. There is no rulebook that one can follow because we have differing salaries and costs.

Ask yourself some questions. For example: Could you save £100 per month? If the answer is “yes”, go ahead and try it for the next 5 months. If the answer is “no”, try to figure out whether you could save £75, £50 or £25 per month and do that for the next 5 months. Whatever the amount you opted to save, after the 5 month you will have already some money in your emergency fund rather than none.

How to save more efficiently

Money provides convenience. We can buy anything we fancy at any price when money isn’t an issue. But those who do not have a lot of money need to compare prices to save money. It takes more time and effort, but financially, it can be rewarding.

Check all the areas in your expenses and see where you can reduce. For example, can you save on your mobile contract or energy provider? Do you have any unused subscriptions? Another way to start saving is reducing the amounts of convenience foods & drinks, no more take away coffee and sandwiches at the deli.

Spend less on food. Most often, we buy branded food items but they are not necessarily better than the supermarket’s own brands which are significantly cheaper. If you know how much you spend monthly on food, try to reduce the amount by 5%. If saving 5% is easy, try to save 10% in the next round. Make a habit of having an almost empty fridge by the end of the week before you go shopping. This way no foods go to waste.

If you browse a lot on the internet, you are spending time being targeted by a super computer. Carefully placed ads with messages that are designed specifically to attract only you. Suddenly there are so many ‘wants’ coming seemingly out of nowhere. Go cold turkey, stop shopping and put the surplus money into your emergency fund at the end of each month.

There are many tools available these days designed to help you save – check out our reviews of the budgeting apps Money Dashboard, Cleo and Snoop. Or look into savings apps such as Plum or Moneybox.

Try to earn more

How about asking for a pay rise, or looking for a better paying job? Having more money will grow your emergency fund faster. If a pay rise or a new job is not an option, then part-time self-employment, or weekend and evening jobs might be the solution. While overworking yourself is not ideal, if its only for a short time it could give your emergency fund that kick that will make it worthwhile.

Pay off the most costly debt first

If you have debt, it would be wise to tackle those repayments with the highest interest first and pay off the minimum on the rest. Then when you have cleared off the debt, start putting the same amount of money into your emergency fund every month.

Everyone can build an emergency fund

It’s not difficult to build an emergency fund. If you spend less than you earn, you will save. If you earn more you will save more. All you need is some careful planning, dedication and patience. It will take time, but once you make a habit out of it, it will become natural. All you need is the first step.